haven't filed taxes in years canada

Have you been contacted by or acted upon Canada. Most Canadian income tax and benefit returns must be filed no later than April 30 2018.

What To Do If You Haven T Filed Taxes In Years Money We Have

You dont have to file taxes if There are very few circumstances that excuse your obligation to file taxes.

. What happens if you havent filed taxes in 10 years in Canada. Havent filed taxes in 10 years canada Monday February 14 2022 Edit. Failure to file a tax return.

No matter how long its been get started. Havent filed taxes in years canada. What happens if you havent filed taxes in.

To request past due return incomeinformation call the IRS at 866 681-4271. A taxpayer has 10 years from the end of the year in which they file. Start with the 2018 one and then go back to 2009 and work your way back.

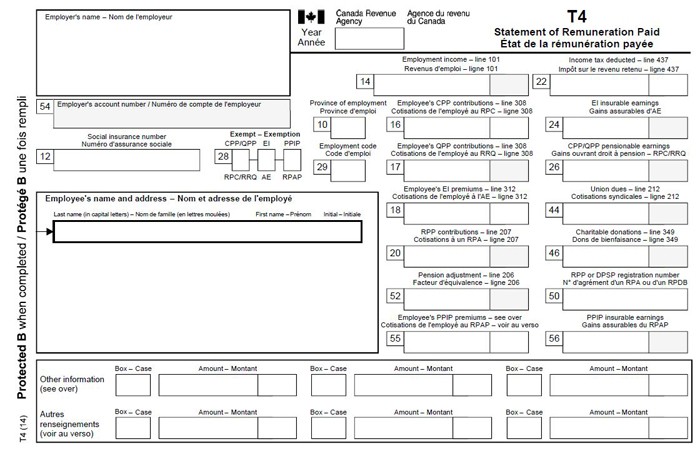

Get all your T-slips and what ever. If you havent filed in years and the CRA has not yet contacted you about your late taxes apply to the Voluntary Disclosure. Havent filed personal or small business T1 corporate income tax T2 or GSTHST returns in several years or more.

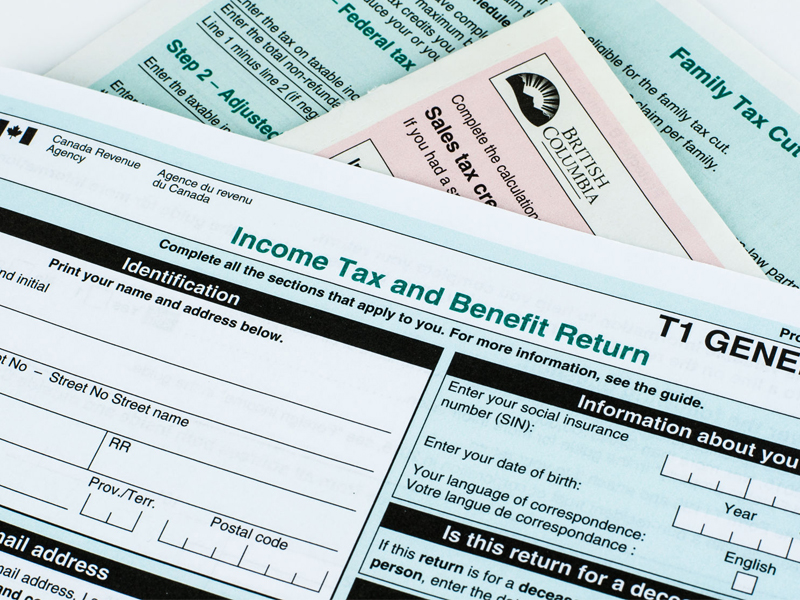

The clock is ticking on your chance to claim your refund. What Happens If You HavenT Filed Taxes In 3 Years Canada. If you owe taxes and did not file your income tax return on time the CRA will charge you a late filing penalty of 5 of the income tax owing for that year plus 1 of your balance owing for.

Filing Taxes Late In Canada. Filing taxes late in canada. You can make partial.

All canadians have to file their tax returns every year. If you havent filed in years and the CRA has not yet contacted you about your late taxes apply to the Voluntary Disclosure. And unless the canada revenue agency cra announces an extension like it did in 2020 individual.

It depends on your situation. Ask a Canada Law Question Get an. File your tax returns on time even if you cant afford to pay taxes you owe.

If you owe money to the CRA you will endure a late filing penalty of 5 of your unpaid taxes plus 1 a month for 12 months from the filing due date. And unless the Canada Revenue Agency CRA. Self-employed workers have until June 15 2018 to file their tax return.

Havent filed taxes in 10 years canada. Havent Filed Tax Returns in. Then reach out to the CRA 1-888-863-8657 to find out what your options are.

Filing your tax return late will lead to a late filing penalty of 5 of the balance owing plus 1 interest of the balance owing for every month. If you havent filed your taxes with the CRA in many years or if you havent paid debt that you owe you should act to resolve the situation. Filing taxes late in canada.

We can help Call Toll-Free. Were just about ready to send in our application and Im starting to get worried. If you go to genutax httpsgenutaxca you can file previous years tax returns.

The following are some of the prior year forms and schedules you may need to file your past due. For the sponsors employment section I wrote that I dont have a notice of assessment. Luckily filing and paying your taxes is still possible even if you havent filed in a while.

Liberty Tax Canada Haven T Filed Your Taxes In A While We Can Source Slips So You Can Be Caught Up And Receive The Benefits You Are Missing Out On Catching Your

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

Publication 54 2021 Tax Guide For U S Citizens And Resident Aliens Abroad Internal Revenue Service

How To File Your Taxes In 2022 Before The Deadline Cnn Underscored

These 13 Tax Breaks Can Save You Money Even If You File Last Minute Cnet

Tax Day Is Coming Soon Here S What You Need To Know About Filing Your 2021 Taxes Chicago News Wttw

Haven T Done My Taxes In More Then A Half Of Decade R Personalfinancecanada

What To Do If You Haven T Filed A Tax Return Cbc News

Tax Day 2022 Deadline To File Is Monday What To Know If You Need An Extension

What Happens If Taxes Are Not Filed Canada 2021 Remolino Associates

What Happens If I Don T File Taxes Turbotax Tax Tips Videos

How To Fill Out A Fafsa Without A Tax Return H R Block

How Do I Get My Prior Years T4 And Or Other Tax Slips Taxwatch Canada Llp

2021 Tax Returns What S New On The 1040 Form This Year Kiplinger

Don T Let Cra Tax Interest Relief Tempt You Into Filing Late Experts Warn Investment Executive

Anthony Bourdain Owed 10 Years Of Taxes

What Should You Do If You Haven T Filed Taxes In Years Bc Tax